ad valorem tax florida statute

Tangible personal property taxes. Furnishings fixtures signs supplies and equipment used in the operation of business.

Terms To Know Before You Start Your Home Search Real Estate Terms Home Buying Process Real Esate

A Tax Deed may be stopped according to Florida Statute 197422 by redemption of all taxes and fees paid to the Tax Collectors Office prior to the recording of the Tax Deed.

. Florida Statute 197374 allows for partial payments to be made on a current year tax for Real Estate or Tangible accounts. Florida property taxes are relatively unique because. Search for your tax account then select the link for your Latest Bill.

Reduction of Ad Valorem Property Tax. Under Florida Statute 197 the Seminole County Tax Collector has the responsibility for the collection of ad valorem taxes and nonad valorem tax assessments. The calculator will automatically default to the minimum required partial payment that you must make 75 of ad valorem taxes.

Taxes must be paid in full and at one time unless the property owner has filed for the installment program or. Disney is fighting back at efforts by Florida lawmakers to repeal the special district that governs Walt Disney World saying a provision in a state law could prohibit such a move. Please visit the Tax Collectors website directly for additional information.

Based on Florida Statute 193052 anyone in possession of assets on January 1 must file a tangible tax return form with the Property Appraisers office no later than April 1 of each year. The Great Depression began in 1929 and caused reforms in ad valorem. There is a third-party fee of 25 of the total amount charged if a credit card is used for all transactions except for online DHSMV registration renewals which come with a third-party fee of 345 per transaction.

Providing that real property includes certain portions. Before buying real estate property be aware that non-ad valorem assessments may have a significant impact on your property tax bill. Florida Statute 197374 allows for partial payments to be made on a current year tax for Real Estate or Tangible accounts.

They are levied annually. The 2021 Florida Statutes. A county may elect to levy and impose the tourist development tax in a subcounty special district of the county.

Sales tax is required by Florida Statute at 6 of the purchase price less trade-in on vehicle purchases. Choose a tax districtcity from the drop down box enter a taxable value in the space provided then press the Estimate Taxes button. Based on Florida Statute 193052 anyone in possession of assets on January 1 must file.

Instead contact this office by. 100 of non-ad valorem taxes. 197162 before the taxes become delinquent.

Please be aware that after you have received a Tax Deed additional activities may be necessary in order to obtain marketable title. Title XIV TAXATION AND FINANCE. 2120305 or to s.

Except where exempted by Florida Statutes or local ordinances. Florida property tax homestead exemption reduces the value of a home for assessment of property taxes by 50000 so a home that was actually worth 100000 would be taxed as though it was worth only 50000. By statute effective July 1 2011 in order to contest the valuation of property before the Board you must pay all of the non-ad valorem assessments and make a partial payment of at least 75 of the ad valorem taxes levied against the property ie.

The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Duval County. 8 of chapter 84-324 Laws of Florida shall be allowed to levy more than the 2-percent tax authorized by this section. Revising the military operations that qualify certain servicemembers.

Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property. Real estate property taxes. There are two types of ad valorem or property taxes collected by the Lee County Tax Collectors office.

Provided to the public on this site is collected and used by the Lake County Property Appraiser for the sole purpose of ad valorem assessment administration in accordance with the Florida Constitution Statutes and Administrative Code. At the bottom of the page click the link for Calculate VAB Good Faith Payment. The Non- Ad valorem tax rolls are prepared by local governments and certified to the Tax Collectors Office for collection.

However the second 25000 of. The Ad Valorem tax roll consists of real estate taxes and tangible personal property taxes and railroad. Less any applicable discount under FS.

Providing for the assessment of land used in the production of aquaculture to be based solely on its agricultural use. These are levied by the county municipalities and various taxing authorities in the county. Applications for transfers and new Business Tax Receipts will only be processed in our Main Office at 400 South Street 6TH Floor Titusville.

Tangible Personal Property Tax is an Ad Valorem tax assessed against some items used in a business or for a commercial purpose. Florida Statute 19601111 mandates that Social Security numbers of the applicant and the applicants spouse if any be provided on new exemption applications for them to be deemed complete. A county that imposes the tax authorized in this paragraph may not expend any ad valorem.

Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property. Save money by utilizing our eCheck option - its free for all tax-related payments and 050 for each DMV-related transaction. Furnishings and appliances provided in a rental unit.

Ad valorem tax means a tax based upon the assessed value of property. This exemption provides ad valorem tax relief equal to the total amount of ad valorem taxes owed on a homestead property of a Florida first. However you may renew your Business Tax Receipt or drop your application off at any of our branch office locations.

Prohibiting counties from imposing requirements on borrowers other than requiring proof of the borrowers income. Disney is fighting back at efforts by Florida lawmakers to repeal the special district that governs Walt Disney World saying a provision in a state law could prohibit such a move. The term property tax may be used interchangeably with the term ad valorem tax.

Per Florida Statute 205194 a copy of your Professional License is required before your Brevard. Tangible personal property tax is an ad valorem tax based on the following categories of property. The Homestead Exemption saves property owners thousands of dollars each year.

Do not jeopardize your Homestead by renting your property. Florida Statutes Tax. You may then pre-file for your 2023 tax year homestead exemption.

Florida Real Estate Taxes What You Need To Know

Public Notice 2021 Tax Roll Open For Payment News Leader Fernandina Beach Florida

Form Dr 462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

When It Comes To Estate Planning It Pays To Consider Each And Every Option For Protecting Your Legacy One Of The Be Estate Planning Life Estate Things To Come

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Florida Revenue Floridarevenue Twitter Disaster Preparedness Preparedness Hurricane Prep

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

Fl Veterans Property Tax Exemptions You Need To Read This Dor Myflorida Com Dor Property Brochures Pt109 Pdf Property Brochures Brochure Property Tax

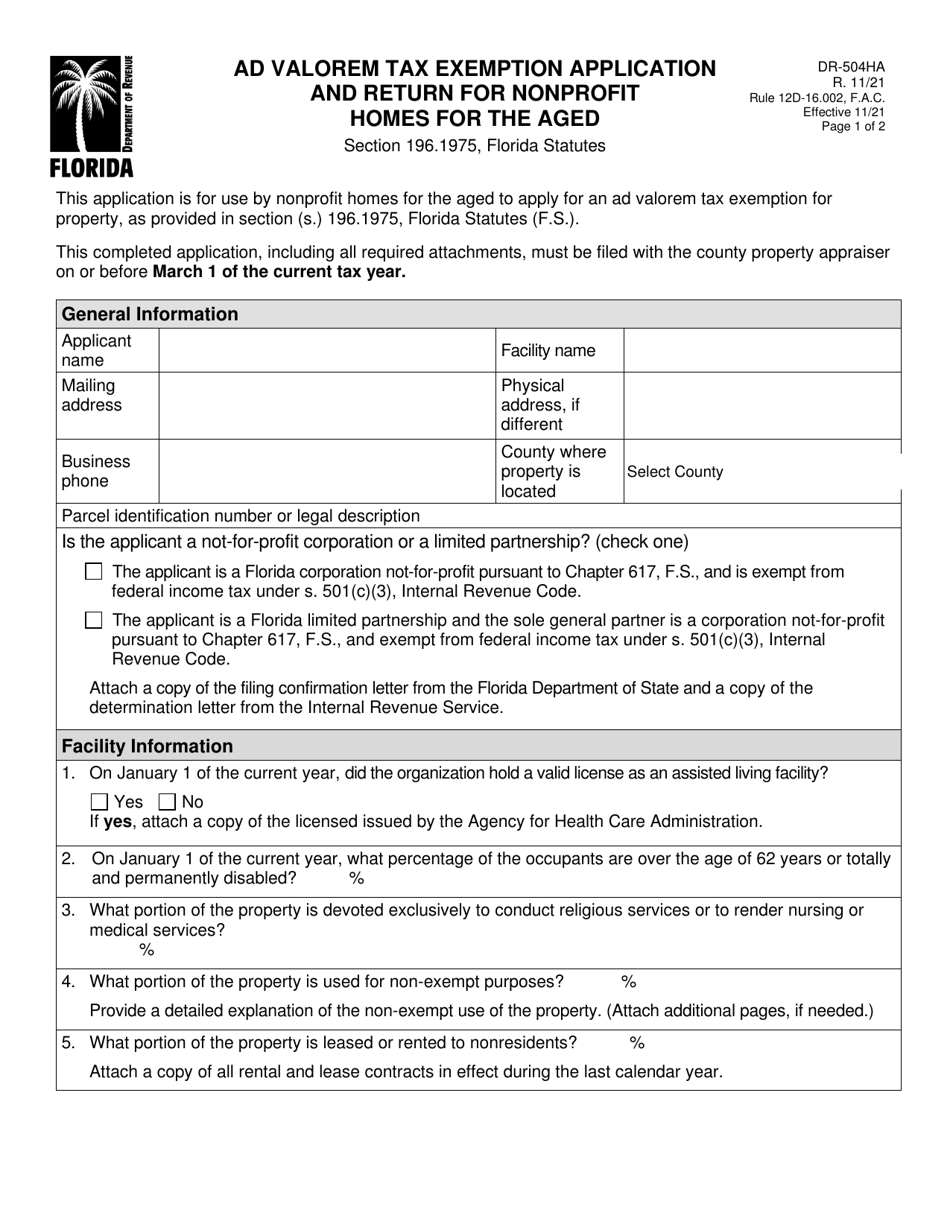

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged Florida Templateroller

Tax Benefits Of Owning A Rental Property Digital Nomad Quest Rental Property Real Estate Rentals Rental Property Investment

Florida S State And Local Taxes Rank 48th For Fairness

Broward County Florida Security Deposit Law Florida Law Broward County Florida Broward County

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

Study Guide For Real Estate Exam Realtor Study And Terms Etsy In 2022 Real Estate Exam Study Guide Exam